Retail traders are making a comeback. After a brief cooldown following the 2021 meme stock frenzy, individual investors are returning to the markets in force—this time, with better tools, smarter strategies, and a growing influence on price movements.

What’s Driving the Resurgence?

- Low barriers to entry: Commission-free trading apps like Robinhood, Webull, and eToro continue to attract new users.

- Financial education boom: YouTube, Twitter, and Reddit now offer more insights than ever before—sometimes even rivaling Wall Street analysts.

- AI-powered tools: Retail traders now use charting bots, alerts, and AI to analyze trends in real time.

Where’s the Action?

- Popular trades in 2025 include AI stocks, semiconductors, green energy, and leveraged ETFs.

- High-volume names like Tesla, Nvidia, and SoFi remain fan favorites, while microcaps see short-lived surges based on social sentiment.

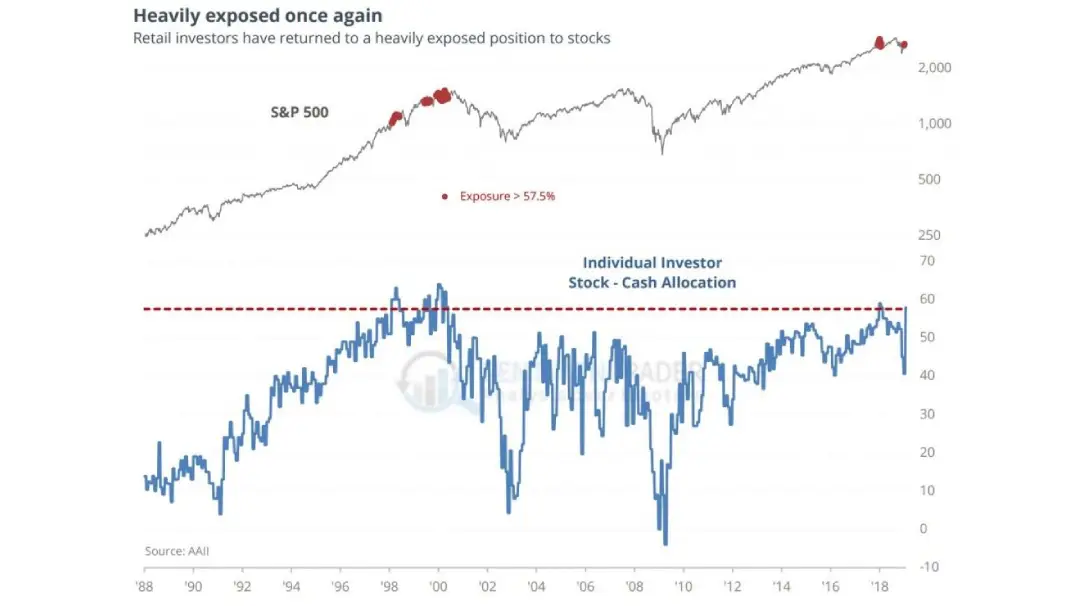

Source says: Retail Investors Are Back. Previously in a recent cycle, retail investors were still bearish on stocks. That has changed. The timing of these surveys is critical because retail investor optimism has exploded in the past couple weeks.

The Retail Effect

Retail investors now account for over 20% of daily market volume in the U.S. alone. Their influence is no longer limited to meme stocks—crowdsourced sentiment is even moving blue-chip names.

A Smarter Crowd?

Compared to 2021, today’s retail traders are more data-driven. Many use risk management tools, diversify portfolios, and follow macroeconomic indicators. It’s no longer just about hype—it’s about strategy.

What It Means for the Market

Institutional investors are taking note. Hedge funds are tracking retail sentiment using AI and adjusting positions accordingly. In some cases, the crowd is beating the pros.

Bottom Line

Retail investors are no longer a side story—they’re part of the market’s backbone. With better tech, deeper insights, and a hunger to win, they’re reshaping the modern investing landscape.