Once, owning a share of companies like Amazon, Tesla, or Berkshire Hathaway meant shelling out hundreds or even thousands of dollars. In 2025, that's no longer the case—thanks to the growing popularity of fractional investing.

What Is Fractional Investing?

Fractional investing allows you to buy a portion of a stock instead of a whole share. If a single share of Nvidia costs $1,200, you can invest just $120 for 0.1 of a share.Why It’s Gaining Ground

- Accessibility: Anyone can now invest in top-performing stocks, no matter their budget.

- Diversification: Investors can spread small amounts across multiple sectors and companies.

- Platforms: Apps like Robinhood, Public, and Fidelity have made fractional shares standard.

Who’s Using It?

Primarily younger investors and first-time traders. With financial literacy on the rise and savings apps growing in popularity, more users are investing spare change into the markets—and building real portfolios over time.

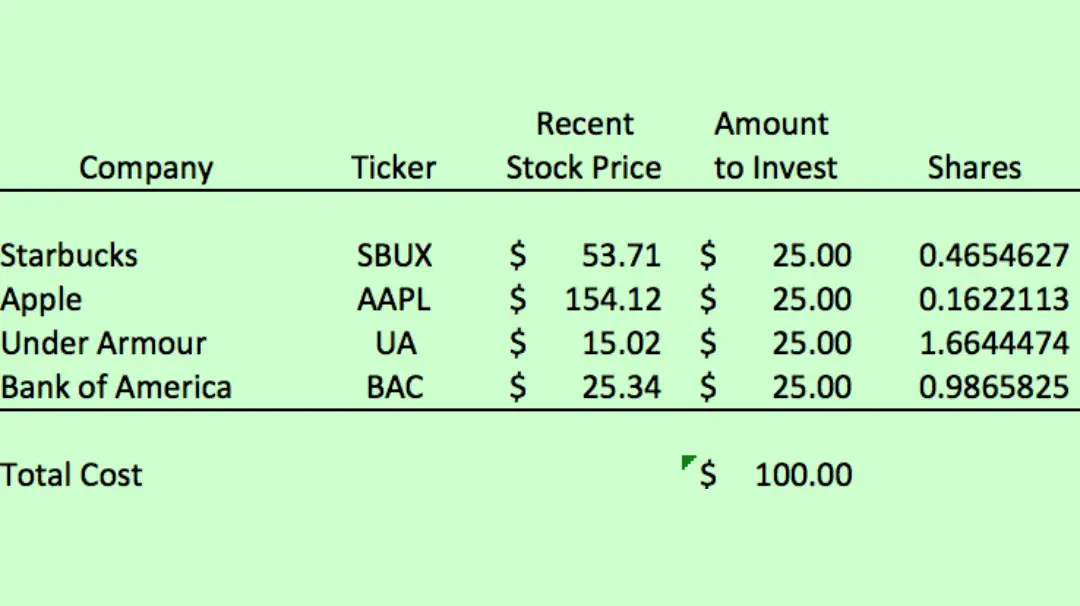

Source says: The idea is that if you are just getting started investing and only have a small amount to invest, like $100 per month, and you have 4 favorite companies, with fractional investing you could invest $25 in each of those companies each month.

Market Impact

While institutions still dominate in volume, retail inflows—especially from micro-investors—have become a steady force. Fractional buying has also contributed to higher liquidity in megacap stocks.

Investor Tips

Even with small amounts, research matters. Fractional investing makes the market more democratic—but the fundamentals of investing still apply. Knowing the business behind the ticker is key.Bottom Line

Fractional shares are transforming how people invest—making the market more open, inclusive, and user-friendly. In a world of high-priced stocks and fast-moving trends, sometimes a fraction is all you need to get started.