Why Stablecoins Matter

Stablecoins act as a bridge between traditional finance and decentralized systems. They power billions in daily transactions, fuel DeFi protocols, and increasingly serve as global payment tools especially in regions where banking access is limited.

Use Cases on the Rise

- Cross-border payments: Instant transfers without banking fees

- DeFi growth: Used as collateral and trading pairs across lending, staking, and swaps

- Inflation shelter: In countries with volatile currencies, stablecoins offer dollar exposure without needing a bank account

The New Leaders

- USDT (Tether) and USDC (Circle) still dominate the market.

- PayPal USD (PYUSD) has gained traction in the U.S. and beyond, expanding stablecoin use to mainstream wallets.

- Decentralized options like DAI are pushing innovation in algorithmic stability.

What’s New in 2025

- Integration with payment processors is expanding, allowing users to pay in stablecoins at checkout.

- Regulatory clarity in regions like the EU and UAE is encouraging banks to explore stablecoin issuance.

- Tokenized real-world assets (RWAs) now use stablecoins as a base layer, linking crypto with bonds, equities, and more.

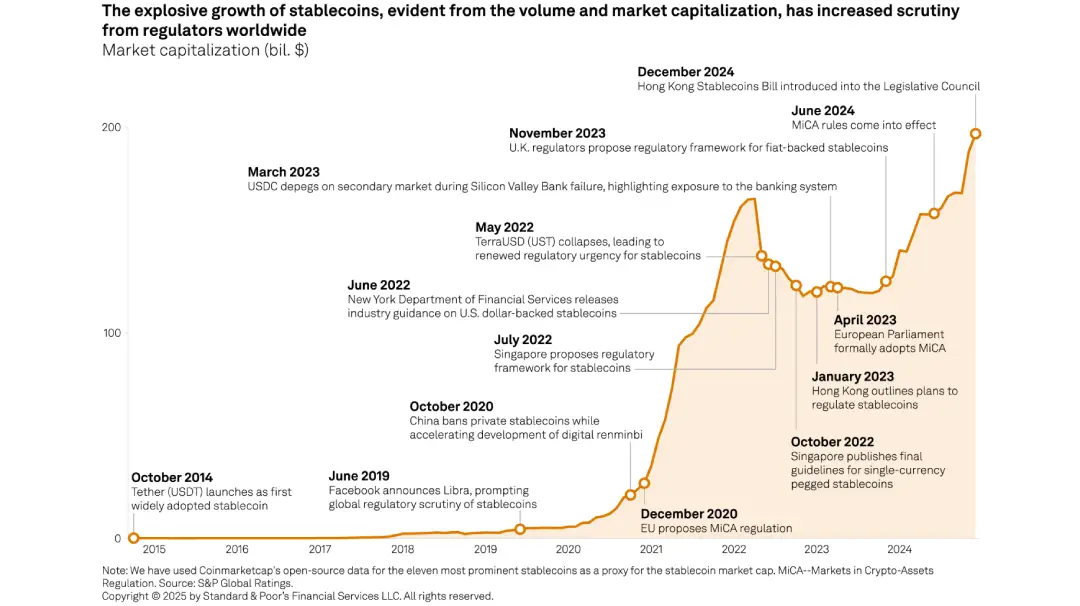

Source says: The explosive growth of stablecoins, evident from the volume and market capitalization, has increased scrutiny from regulators worldwide.

Bottom Line

Stablecoins are no longer just tools for traders they’re becoming a core financial layer in the digital economy. As adoption spreads, the world may not shift directly to Bitcoin but it might quietly start running on stablecoins.