What Is Self-Custody

Self-custody means you control your private keys — and therefore your assets. Instead of relying on centralized exchanges or custodians, users store their crypto in personal wallets like Ledger, Trezor, MetaMask, or mobile apps with secure key management.

Why It’s Gaining Popularity

- Security: Exchange hacks and shutdowns have reminded users that funds stored on platforms are vulnerable.

- Better tools: Wallets have become easier to use, with sleek interfaces and backup options like social recovery or multi-sig.

- DeFi and Web3 access: Self-custody is essential for interacting with DeFi apps, DAOs, and NFT marketplaces directly.

Major Trends in 2025

- Hardware wallet sales are up 40% year-over-year, driven by both retail and institutional users.

- Smart contract wallets are rising — offering automated bill pay, spending limits, and programmable permissions.

- MPC wallets (multi-party computation) are attracting users who want security without seed phrases.

Not Without Risks

Self-custody comes with responsibility: lose your keys, and your assets are gone. But modern wallets are reducing that risk with backups, guardians, and user-friendly security flows.

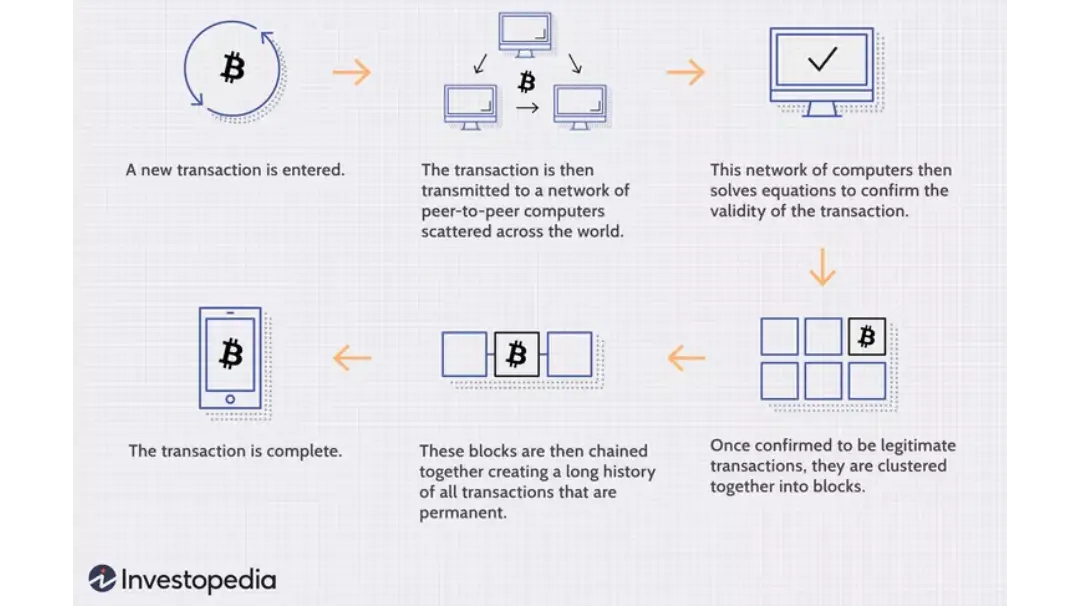

Source says: In Bitcoin, your transaction is sent to a memory pool, where it is stored and queued until a miner picks it up. Once it is entered into a block and the block fills up with transactions, it is closed, and the mining begins.

The Bottom Line

In 2025, crypto users are becoming more conscious — not just of price, but of control. As infrastructure improves, self-custody is becoming the default mindset, not the exception.