What Is DeFi Lending & Borrowing

Decentralized finance (DeFi) platforms like Aave, Compound, and MakerDAO allow users to lend their crypto and earn interest or borrow against their assets, all without the need for intermediaries like banks. Instead, smart contracts manage the entire process, ensuring transparency and automation.

Why DeFi Is Surging in 2025

- Higher yields: DeFi lending often offers far higher interest rates than traditional savings accounts or bonds.

- Global access: Anyone with internet access can participate, even in countries with limited access to traditional banking.

- Collateralized borrowing: Borrowers don’t need to go through credit checks. Instead, they lock up collateral (crypto) and can access liquidity within minutes.

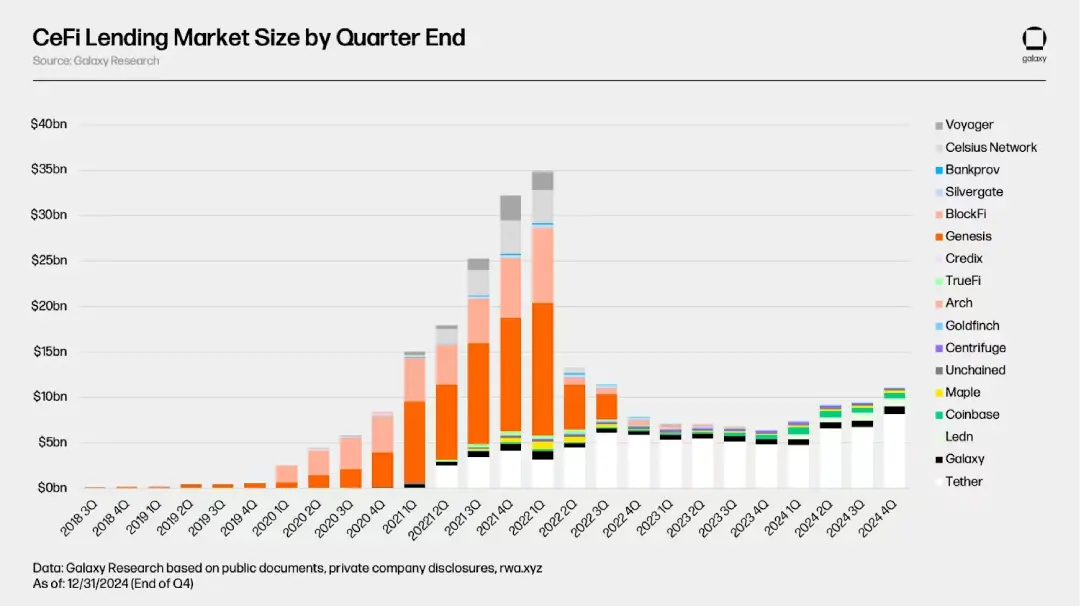

Source says: The combined size of the DeFi and CeFi crypto lending markets is still meaningfully off the highs achieved in Q1 2022 as measured using end-of-quarter snapshots.

The Evolution in 2025

- Lending yields are stabilizing, becoming more predictable, which attracts institutional investors.

- Hybrid models are emerging where centralized exchanges integrate DeFi lending tools to offer the best of both worlds.

- Risk management is evolving with insurance protocols and credit scoring mechanisms emerging to reduce the volatility risks traditionally associated with DeFi.

What Are the Risks

While DeFi presents enticing opportunities, it also carries risks. Smart contract vulnerabilities, impermanent loss, and liquidity issues remain concerns, especially for newer users. However, innovative protocols are actively addressing these challenges, improving security, and providing more liquidity options.

The Bottom Line

DeFi lending and borrowing are opening new possibilities for earning passive income and accessing liquidity without intermediaries. With improvements in security, risk management, and institutional involvement, DeFi is on track to become a core component of the global financial ecosystem in 2025.