What’s Driving the Shift?

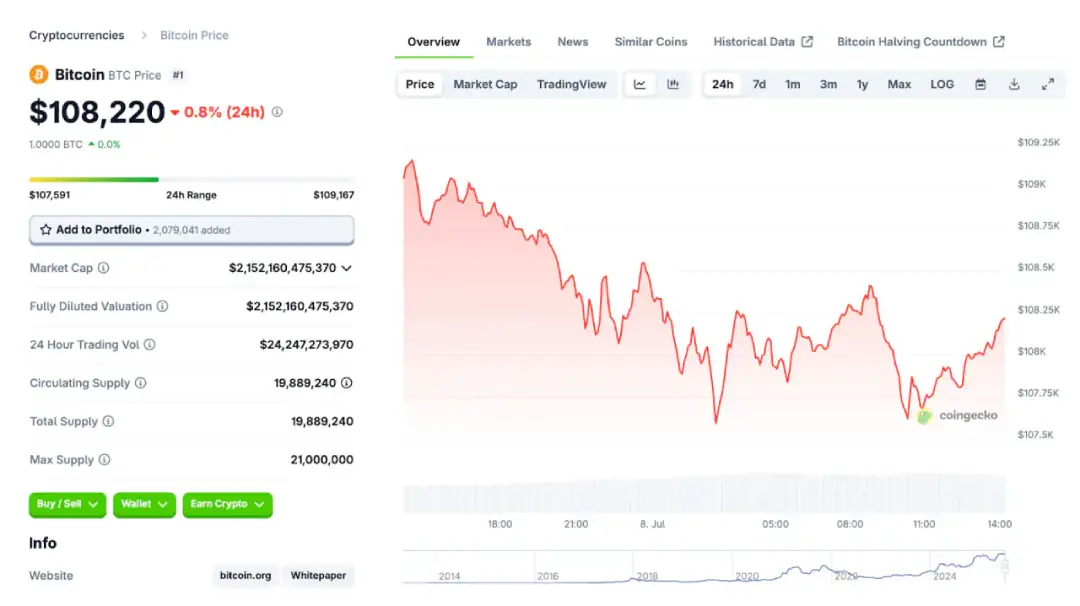

- Bitcoin dominance peaked at over 54% earlier this year but is now falling as traders rotate into high-potential altcoins.

- Layer 2 ecosystems like Arbitrum and Optimism are growing rapidly, bringing new DeFi and gaming projects to market.

- AI-related tokens (FET, RNDR, AGIX) are rising alongside global excitement around artificial intelligence.

- Real-world asset protocols (Ondo, Centrifuge) are gaining adoption with tokenized bonds and treasury products.

Key Narratives in Focus

- AI & Decentralized Compute: Tokens powering AI infrastructure, data storage, and model training are gaining real usage.

- RWA Tokens: Crypto meets TradFi, offering yield-bearing assets on-chain.

- Scalability Solutions: L2 tokens benefit from lower fees and rising total value locked (TVL).

Even niche chains like Avalanche and Cosmos are seeing renewed developer activity and user growth.

Source says: That pattern appears to be holding true in Q3 2025 as traders hunt for higher ROI across emerging tokens and especially on presales. This stability also reduces volatility across the board, encouraging broader participation in alternative markets.

What Analysts Say

Analysts caution that this isn’t 2021. "Projects with no users won’t last," one notes. Today’s rally favors fundamentals, utility, and revenue, not just hype.

Bottom Line

Altcoin season 2025 may be real — but it’s different. This wave is being driven by AI, DeFi infrastructure, and tokenized assets, not memecoins. Smart investors are watching where real demand is going.